Married Filing Jointly Deduction 2024. Single and married filing separately: Nerdwallet is a free tool to find you the best credit cards, cd rates, savings, checking accounts, scholarships, healthcare and airlines.

In 2023, married filing separately taxpayers get a standard deduction of $13,850. Single and married filing separately:

The 2023 Standard Deduction Is $13,850 For Single Filers And Those Married Filing Separately, $27,700 For Those Married Filing Jointly, And $20,800 For Heads Of Household.

It is claimed on tax.

For Single Taxpayers And Married Individuals Filing Separately, The Standard Deduction Rises To $14,600 For 2024, An Increase Of $750 From 2023;

You can choose married filing jointly as your filing status if you are considered married and both you and your spouse agree to file a joint return.

Increase Of $750 From The.

Images References :

Source: www.youtube.com

Source: www.youtube.com

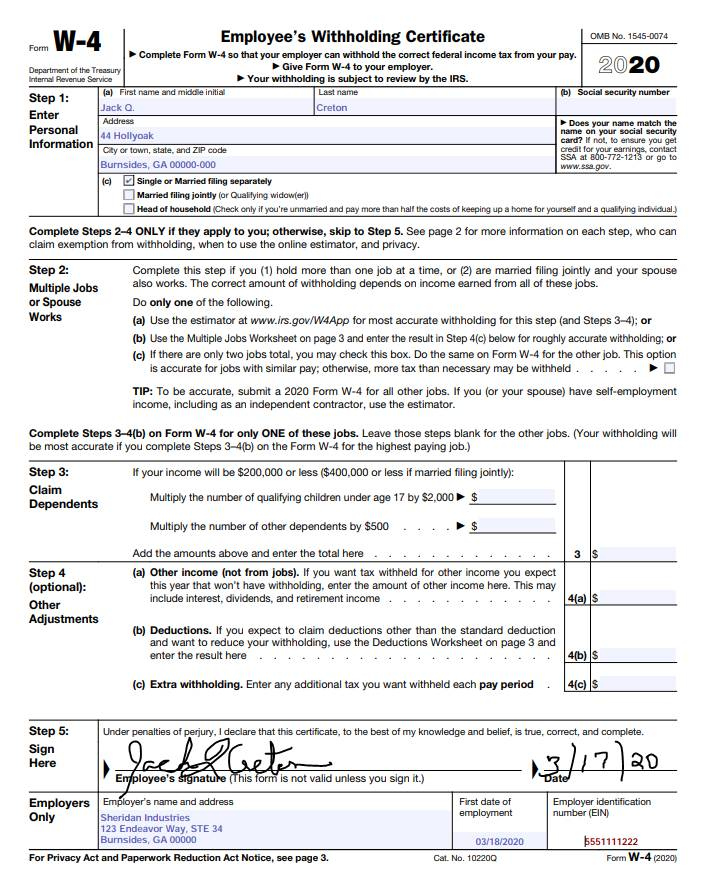

How to fill out IRS Form W4 Married Filing Jointly 2022 YouTube, That’s up $1,900 from last year. This applies to taxes filed by april 15, 2024, or by oct.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, This applies to taxes filed by april 15, 2024, or by oct. Start here to maximize your rewards or minimize your.

Standard deduction Married filing jointly and surviving spouses Single, The amt exemption is $85,700 for single filers, $133,300 for married filing jointly, $66,650 for married filing separately and $29,900 for estates and trusts. Compare this to the $27,700 that those who.

Source: printableformsfree.com

Source: printableformsfree.com

How To Fill Out W 4 Form Married Filing Jointly 2023 Printable Forms, Married couples filing jointly are taxed at the 10% rate on their first $22,000 in income during the 2023 tax year, increasing to $23,200 for 2024. And for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the.

Source: www.youtube.com

Source: www.youtube.com

How to fill out IRS Form W4 Married Filing Jointly 2021 YouTube, Start here to maximize your rewards or minimize your. What is the standard deduction for married filing jointly?

Source: hopevirals.blogspot.com

Source: hopevirals.blogspot.com

Married Filing Jointly Tax Brackets 2022 2022 Hope, The standard deduction is a set amount that you can deduct from your income before you are taxed. If you and your spouse are both 65 or older, or if.

Source: www.youtube.com

Source: www.youtube.com

Married FILING JOINTLY vs. SEPARATELY in 2024 Which Is Better? YouTube, Separate tax returns may result in more tax. Increase of $1,500 from the 2023 amount:

The IRS Just Announced 2023 Tax Changes!, For taxpayers who are married and filing jointly, the standard deduction for the 2024 tax year was increased to $29,200, up $1,500 from 2023. The amt exemption is $85,700 for single filers, $133,300 for married filing jointly, $66,650 for married filing separately and $29,900 for estates and trusts.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, 15, 2024, with an extension. 2024 extra standard deduction age 65 and older (married filing jointly or separately) 65 or older or blind:

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Source: projectopenletter.com

Source: projectopenletter.com

2022 Tax Tables Married Filing Jointly Printable Form, Templates and, Compare this to the $27,700 that those who. And for heads of households, the standard deduction will be $21,900 for tax year 2024, an increase of $1,100 from the.

Married (Filing Joint Returns) ≤ $123,000:

What is the standard deduction for married filing jointly?

This Applies To Taxes Filed By April 15, 2024, Or By Oct.

Married filing jointly or married filing separately.