Boi Report For Llc 2024. Provides interactive checklists, infographics, and other tools to assist businesses in complying with the boi reporting rule. The requirements become effective on january 1,.

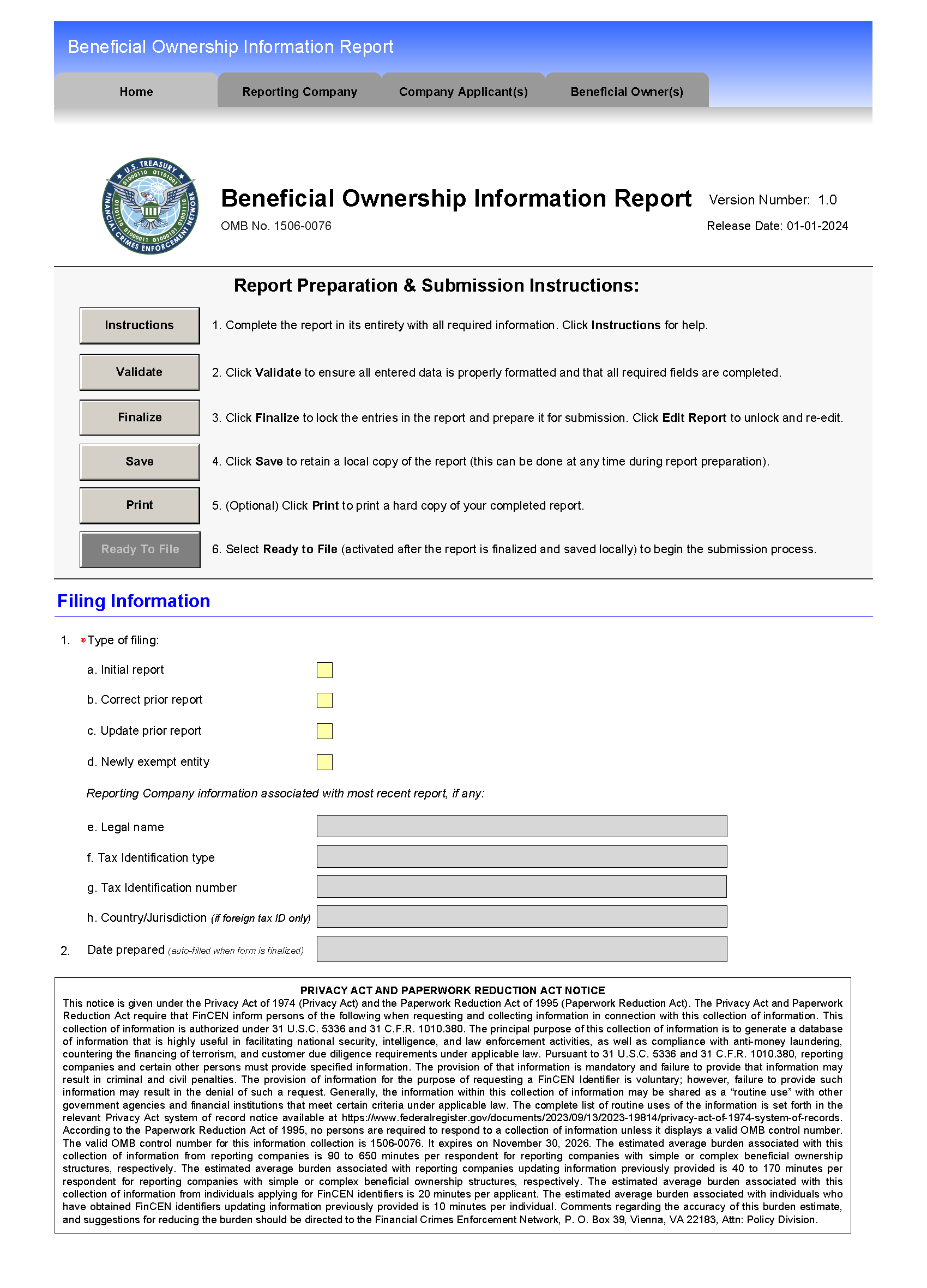

The following materials are now available on fincen’s beneficial ownership information reporting webpage, www.fincen.gov/boi: Beginning january 1, 2024, certain types of limited liability companies, corporations, and other similar entities must report information about their beneficial owners—the persons who.

Boi Report For Llc 2024 Images References :

Source: www.youtube.com

Source: www.youtube.com

New 2024 FINCEN Reporting for LLC, 500 a Day Fines File BOI Report, Beginning january 1, 2024, certain types of limited liability companies, corporations, and other similar entities must report information about their beneficial owners—the persons who.

Source: www.youtube.com

Source: www.youtube.com

BOI LLC 2024 . Any Reporting Company Created Or Registered On Or After, 1, 2024, the cta requires corporations, limited liability companies (llcs), and other entities organized or registered to do business in the united states to file a.

Source: www.youtube.com

Source: www.youtube.com

How to File a BOI Report for Your LLC (StepByStep) YouTube, Failure to properly file a boi report may incur severe civil and criminal penalties, including fines of up to $100,000.

Source: eforms.com

Source: eforms.com

Free Beneficial Ownership Information (BOI) Report PDF eForms, In 2024, some businesses will be required to report their beneficial ownership information (boi).

Source: easyfiling.us

Source: easyfiling.us

BOI Report for LLC How to File a BOI Report for LLC?, When is my llc's initial boir due?

Source: www.youtube.com

Source: www.youtube.com

FINCEN BOI REPORT 2024 (Beneficial Ownership Information) YouTube, You must file an updated report within 30 days of any change to previously reported information [2].

Source: legalregistration.com

Source: legalregistration.com

BOI Report for LLC, Beneficial Ownership Information For LLC, Suspicious activity report (sar) advisory key terms;

Source: www.cbh.com

Source: www.cbh.com

BOI Reporting Regulations Effective January 2024 Cherry Bekaert, Starting january 1, 2024, certain u.s.

Source: www.fincen.gov

Source: www.fincen.gov

Beneficial Ownership Information FinCEN.gov, Only llcs created in 2024 and beyond are required to do so.

Source: www.tax1099.com

Source: www.tax1099.com

FINCEN BOI Reporting Tax1099 Blog, You must file an updated report within 30 days of any change to previously reported information [2].

Posted in 2024